Yes, that's right, McDonald's, the fast food chain, is more credit-worthy than the United States of America!

Yes, that's right, McDonald's, the fast food chain, is more credit-worthy than the United States of America!But, maybe it isn't so surprising in these uncertain economic times. With food prices rising, unemployment going up, banks failing, housing prices collapsing, and President Bush pushing a $700 billion bailout package for Wall Street (and the question of whether or not the US House and Senate will pass it), I suppose it shouldn't surprise us that the rest of the world sees the US as a risky investment.

How is it that McDonald's is deemed more credit-worthy than the US?

Here's how it is explained in Finland's Helsingin Sonomat (as translated by Watching America):

The insurance risk-premium for a 10-year U.S. treasury bond shifted on Friday up to 0.3% according to a broker in a Finnish bank. In practice this means that if an investor wishes to insure 10 million dollars worth of U.S. T-bonds against a government default the insurance will cost 30,000 dollars. Such an insurance for the same amount of investments on Finnish bonds cost on Friday only about half of that at 16,000 dollars. Even loans to McDonald’s would be cheaper to insure than U.S.-bonds, at 28,000 dollars per 10 million.

CDS-derivative prices are an indicator of investors’ views and mood, but as such they reveal nothing of the true financial state and wealth of their targets. Thus, while Finland’s and McDonald’s risk of bankruptcy is now smaller in investors’ opinion than that of the U.S. this does not mean that Finland and McDonald’s would necessarily be any wealthier and thus safer targets of investment than the U.S.

This being said, it is extremely rare for a fast-food chain’s corporate loan to be viewed as a safer investment than the bonds of the world’s most powerful country.

Hardee's has an answer for that eternal question: "What would happen to a Thickburger if you threw it in a cold swimming pool?" (see the first video below)

Hardee's has an answer for that eternal question: "What would happen to a Thickburger if you threw it in a cold swimming pool?" (see the first video below)

Sonic Drive-In is offering 3 hamburgers made with 100% Angus beef.

Sonic Drive-In is offering 3 hamburgers made with 100% Angus beef.

Arby's now has a new snack item they're calling "Mac & Cheezers."

Arby's now has a new snack item they're calling "Mac & Cheezers."

A Wendy's fast food restaurant in the small town of Firestone, Colorado has been chosen as the best Wendy's in the world.

A Wendy's fast food restaurant in the small town of Firestone, Colorado has been chosen as the best Wendy's in the world.

Hardee's has announced the return of their Pork Chop 'N' Gravy Biscuit. And now they've added gravy.

Hardee's has announced the return of their Pork Chop 'N' Gravy Biscuit. And now they've added gravy.

Carl's has a coupon right now for

Carl's has a coupon right now for

I've always wanted to do this, but never got around to it. Morgan Spurlock did it in

I've always wanted to do this, but never got around to it. Morgan Spurlock did it in  J. Scott Wilson at WPBG-TV, the ABC affiliate in West Palm Beach, Florida has written an article about and

J. Scott Wilson at WPBG-TV, the ABC affiliate in West Palm Beach, Florida has written an article about and  Burger King is

Burger King is

Quizno's fast food sandwich shops around the country are operated by franchisees who pay Quizno's for the right to open one of their restaurants (and for the building and equipment, etc).

Quizno's fast food sandwich shops around the country are operated by franchisees who pay Quizno's for the right to open one of their restaurants (and for the building and equipment, etc). Del Taco has introduced their "Classic Taco" for 99 cents.

Del Taco has introduced their "Classic Taco" for 99 cents.

Taco Bueno has added new flame-grilled items to their menu, including Fajita Tacos, Gourmet Burritos and Gourmet Bowls.

Taco Bueno has added new flame-grilled items to their menu, including Fajita Tacos, Gourmet Burritos and Gourmet Bowls.

This is a subtle campaign, and something Fletcher Martin is probably only doing in their HQ of Atlanta... a little guerrilla marketing fun for their creative department.

This is a subtle campaign, and something Fletcher Martin is probably only doing in their HQ of Atlanta... a little guerrilla marketing fun for their creative department.  A sign of the times? Just as we're trying to save money in these trying economic times, the fast food giants are trying to make enough money to cover their expenses.

A sign of the times? Just as we're trying to save money in these trying economic times, the fast food giants are trying to make enough money to cover their expenses.

WingStreet, the world’s largest delivery wing restaurant announced today that it is on track to double in size in 2008. Fueled by consumer demand, the wing chain is expected reach the 2,000 restaurant milestone by 2009.

WingStreet, the world’s largest delivery wing restaurant announced today that it is on track to double in size in 2008. Fueled by consumer demand, the wing chain is expected reach the 2,000 restaurant milestone by 2009. In June of 2003

In June of 2003  Shareholders of Arby's parent company Triarc and Wendy's approved the merger of the two fast food restaurant chains.

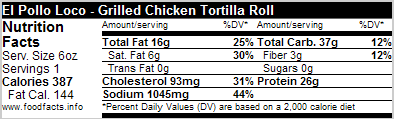

Shareholders of Arby's parent company Triarc and Wendy's approved the merger of the two fast food restaurant chains. Over the weekend El Pollo Loco introduced their new Grilled Chicken Tortilla Roll. It has citrus-marinated, grilled chicken with Jack and cheddar cheeses rolled in a flour tortilla and grilled.

Over the weekend El Pollo Loco introduced their new Grilled Chicken Tortilla Roll. It has citrus-marinated, grilled chicken with Jack and cheddar cheeses rolled in a flour tortilla and grilled.

Okay fast food fans, here's a new project for you! Make your own 'Burger Shop' tray of fast food out of paper!

Okay fast food fans, here's a new project for you! Make your own 'Burger Shop' tray of fast food out of paper! If you're in a band and hungry (synonymous?) you need to hurry over to Taco Bell's

If you're in a band and hungry (synonymous?) you need to hurry over to Taco Bell's  In reporting their 3rd quarter financial trends last week, Chipotle mentioned that they are "working on national pricing plans for the fourth quarter of 2008 to offset rapidly rising food costs."

In reporting their 3rd quarter financial trends last week, Chipotle mentioned that they are "working on national pricing plans for the fourth quarter of 2008 to offset rapidly rising food costs." A new report has ranked

A new report has ranked  Burger King has a new online advertising vehicle: "Seth MacFarlane's Cavalcade of Cartoon Comedy."

Burger King has a new online advertising vehicle: "Seth MacFarlane's Cavalcade of Cartoon Comedy."

Panera has introduced a new Panini, the Tomato & Mozzarella. It includes fresh mozzarella, roasted and fresh tomatoes, fresh basil and sun-dried tomato pesto on Ciabatta.

Panera has introduced a new Panini, the Tomato & Mozzarella. It includes fresh mozzarella, roasted and fresh tomatoes, fresh basil and sun-dried tomato pesto on Ciabatta.

KFC is making a big deal about moving Col. Sander's original, hand-written, top-secret "Original Recipe" to a new, more secure location. Clearly a way to get their name (their new name, KFC, not the original name, Kentucky Fried Chicken, since their afraid of the word 'fried' now) into the news cycle this week.

KFC is making a big deal about moving Col. Sander's original, hand-written, top-secret "Original Recipe" to a new, more secure location. Clearly a way to get their name (their new name, KFC, not the original name, Kentucky Fried Chicken, since their afraid of the word 'fried' now) into the news cycle this week.

There are now 2 "KFC" restaurants in Kabul, Afghanistan. But in this case, KFC doesn't stand for Kentucky Fried Chicken, it stands for Kabul Fried Chicken.

There are now 2 "KFC" restaurants in Kabul, Afghanistan. But in this case, KFC doesn't stand for Kentucky Fried Chicken, it stands for Kabul Fried Chicken. Okay fast food lovers, can you do without your meatlicious fast food one day a week?

Okay fast food lovers, can you do without your meatlicious fast food one day a week?